County leaders call on lawmakers to pass billion-dollar tax loophole package

Several county leaders called on state lawmakers Wednesday to ignore special interests and campaign donors and pass a proposal that would raise $1.6 billion in new tax revenue.

A coalition of more than two dozen groups and progressive lawmakers want to implement combined reporting for corporations doing business in Maryland, which treats a parent corporation and its subsidiaries as one corporation for state income tax purposes. The bill is one of a number of tax measures mired in the Senate, where leaders say this is not the year for any revenue increases.

Executives from Anne Arundel and Montgomery counties said the bills are blocked because some lawmakers are beholden to corporate donors.

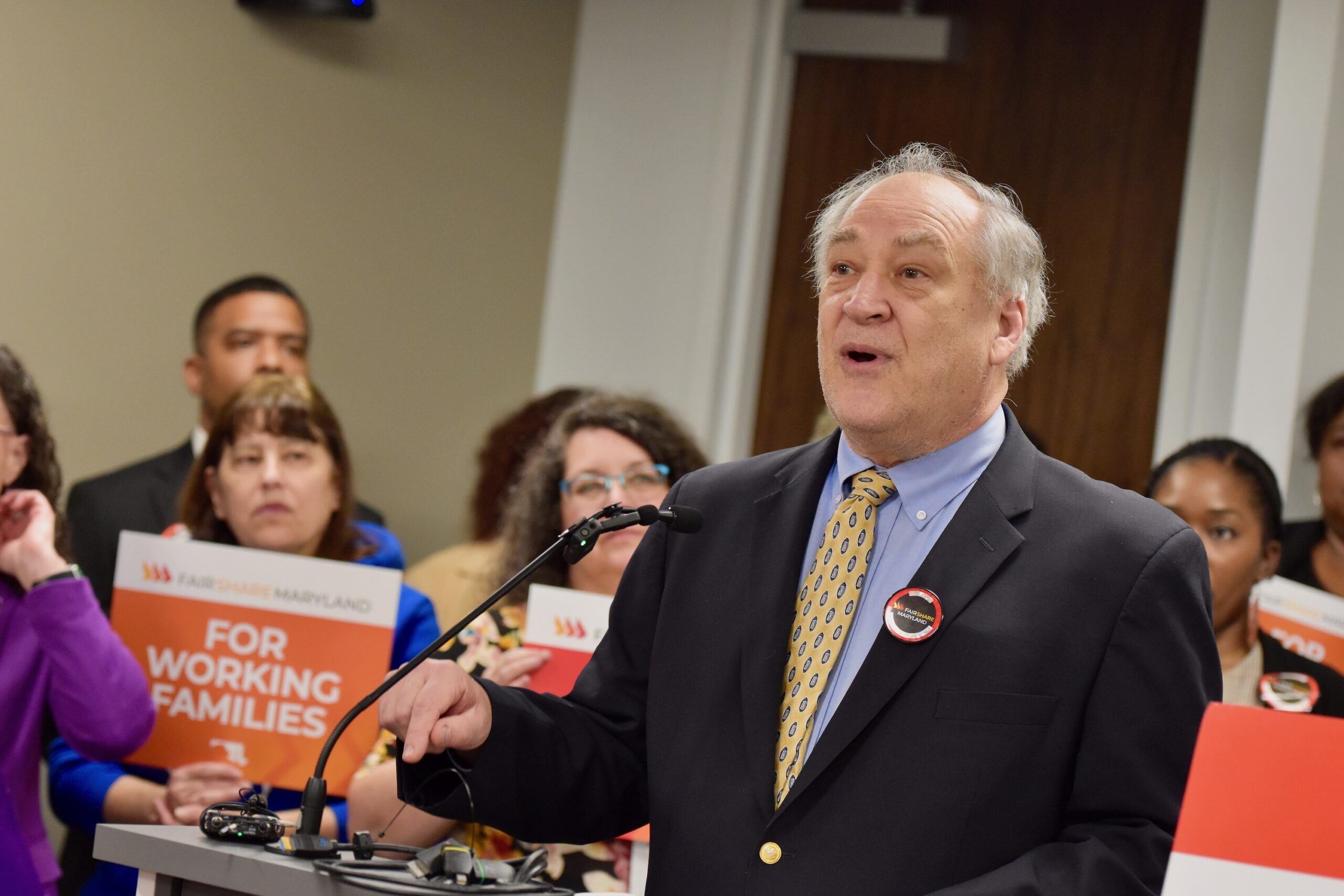

Anne Arundel County Executive Steuart Pittman (D). Photo by Bryan P. Sears.

“Loopholes are everywhere for interests that lobby for loopholes,” said Anne Arundel County Executive Steuart Pittman (D). “Maryland is not much better. A third of our largest corporations paid zero income tax, but the wealthiest 1% of our residents pay a smaller share of their income than the rest of us. It’s baked into the system. Legislators survive on a diet of campaign contributions to get into office and to stay there. The largest donors tend to be the very interests lobbying for loopholes and opposing a fair distribution of the tax burden.”

Pittman, Frederick County Executive Jessica Fitzwater (D), and Montgomery County Executive Marc Elrich (D) joined members of Fair Share Maryland at a midday rally in Annapolis Wednesday. All three noted growing budget constraints that will force cuts to priorities.

Elrich said the frequent criticism is that governments “have to live within our means.”

“These are not set down by some god on high and engraved in stone. It’s actually a decision about your tax policy and the tax rate,” said Elrich, adding later: “We need to redefine our means. And fair taxation redefines our means to brings money into the state budget and brings money into local budgets that let us do the things we need to do to be successful and to be competitive.”

But Elrich agreed with Pittman that some lawmakers may feel indebted to donors.

“Those checks do not come without strings,” said Elrich. “Nobody should be confused. You’ll hear people say these are our friends. Yeah. OK. They’re friends and the friends will come with asks.”

Ehrlich won his two elections for county executive while participating in Montgomery County’s new public financing system, which limits big money and requires candidates to collect small-dollar donations to receive a public match.

Fair Share Maryland. Photo by Bryan P. Sears.

House and Senate versions of the taxation bill propose:

- A tax increase on people whose income is $1 million a year or more. The tax increase would generate an estimated $419 million annually.

- Reversing a 2014 estate tax exemption and reinstating a $2 million exemption. The change would generate an estimated $84 million annually.

- “Significantly” increasing the number of state tax auditors. The advocacy group, using IRS estimates on under-reported taxes, said Maryland likely loses $3 billion annually in unpaid taxes.

- Adding a 1% surcharge on capital gains, generating a projected $157 million annually.

Advocates estimate the changes would generate $1.6 billion once fully phased in that could help pay for the state’s Blueprint for Maryland’s Future education plan. The proposal also includes $406 million in tax credits for some low-wage earners.

Fitzwater said the changes will help the state and counties without additional income or property taxes.

“For me ensuring that we are not increasing taxes on our overburdened residents is incredibly important,” she said. “Not only does this bill refrain from taxing working class families, it provides a pathway for cutting taxes from more than 1 million Marylanders. The state of Maryland, as you’ve heard, is leaving millions of dollars on the table due to a tax system that allows for corporate and [top] 1% tax loopholes. The revenue that will be raised through this act is needed to support our schools, invest in health care, address transportation needs and so much more.”

Frederick County Executive Jessica Fitzwater (D). Photo by Bryan P. Sears.

The state is staring down a looming budget problem that could balloon to $3 billion in the coming years.

This year alone, lawmakers are wrestling with hundreds of millions in structural budget deficits.

The Senate Budget and Taxation is expected to finalize its version of Gov. Wes Moore’s proposed fiscal 2025 budget this week.

Next year, the deficit is projected to reach $1 billion, according to legislative analysts. In fiscal 2027, the last year of Moore’s term, it would grow to $1.3 billion. A year later, it would more than double to $3 billion — about 12% of the general fund revenues projected for that year.

The deficit projections are the largest since the Great Recession, those analysts said.

On Thursday, the Board of Revenue Estimates is expected to deliver more bad news in the form of revenue write downs. Advocates and others say the amount could be in the low hundreds of millions.

“We’re expecting a bit of a write down,” Senate President Bill Ferguson (D-Baltimore City) told reporters Tuesday. “That is totally anticipated, and we sort of built in our expectations for that.”

Ferguson could offer no specifics on the size or nature of the revenue reduction.

Lawmakers in the House have signaled a willingness to pass some tax increases this year. Ferguson and Senate Budget and Taxation Chair Guy Guzzone (D-Howard) have repeatedly said this is not the year for broad tax bills.

Similarly, Moore appears — at least for now — to not see the urgency in raising taxes.

“We don’t need to raise taxes right now,” Moore told reporters last week. “I just know that the bar for raising taxes not just this year, but for every single year for me, it’s going to be a very high bar.”

Creative Commons Attribution

Creative Commons Attribution