Coalition of progressive advocates, lawmakers seek tax changes

A coalition of more than two dozen groups and progressive lawmakers are hoping to leverage looming state fiscal challenges to pass long-desired tax reforms.

Advocates describe the as-yet-to-be-introduced omnibus bill as covering roughly a half-dozen policies that have been proposed in separate bills as recently as two years ago. The legislation would raise $1.6 billion annually — once fully phased in — for the state’s general fund, potentially offsetting billions in projected deficits and paying for tax credits for some low-income earners.

Sen. Shelly Hettleman (D-Baltimore County). Photo by Bryan P. Sears.

“Our budget reflects our values,” said Sen. Shelly Hettleman, (D-Baltimore County), a member of the Senate Budget and Taxation Committee and sponsor of the Senate version of the legislation.

“I’d even take it a step further,” she said. “To say that how we pay for that budget reflects our values. We have a tax system. That’s not fair. It’s not fair when lower income folks are paying a higher percentage of their income on taxes than wealthier folks. When the richest 1% are not paying their fair share. And when corporations are not paying their fair share, hurting the small businesses in our communities that are.”

Del. Julie Palakovich Carr (D-Montgomery) will sponsor an identical bill in the House.

“The choice is simple,” said Palakovich Carr, a member of the House Ways and Means Committee. “We can either meet the needs of working Maryland families or we can continue to give tax breaks to the wealthy few. Right now, the wealthiest 1% of Marylanders pay the smallest share of their income on state and local taxes. It’s simply unfair that someone making a million dollars or more a year has a smaller tax burden than a teacher, a nurse or firefighter.”

And while the bills have yet to be introduced, the Maryland Fair Funding Coalition plans to push the idea through the halls of the State House. The group will also attempt to move the needle on public opinion with a $100,000 television and radio ad campaign.

Late last year, the group spent $250,000 on a related campaign.

A handout from the group outlined some of the proposed changes including:

- A 7% tax increase on people whose income is $1 million a year or more. The tax increase would generate an estimated $419 million annually.

- Reverse a 2014 estate tax exemption and reinstate a $2 million exemption. The change would generate an estimated $84 million annually.

- “Significantly increase” the number of state tax auditors. The group, using IRS estimates on under-reported taxes, said Maryland likely loses $3 billion annually in unpaid taxes.

- Add a 1% surcharge on capital gains, generating an estimated $157 million annually.

Among supporters of the bill is the NAACP Maryland State Conference.

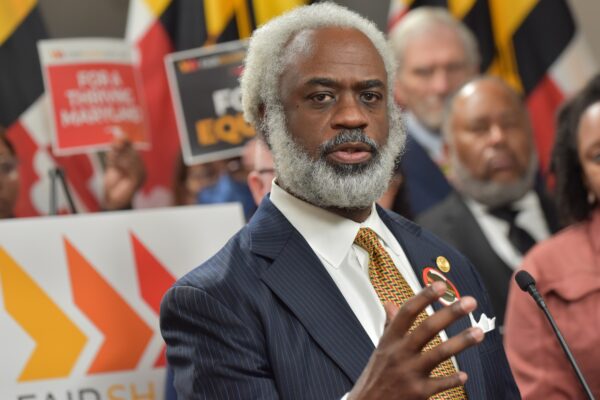

Kobi Little, president of the NAACP Maryland State Conference. Photo by Bryan P. Sears.

Kobi Little, president of the state conference, said the bill will address social inequities faced by Black and brown communities.

“The reason why it is important is because for so long, in the United States, and in this state, we have placed the burden, the brunt, and the weight on the most vulnerable and those who are experiencing economic insecurity, those who are not able to advocate for themselves,” Little said. “While the powerful, the wealthy, the strong, the rich, have a field day, and this legislation shifts the paradigm. It says that corporations can’t hide behind loopholes. It says that corporations must pay their fair share. It says there won’t be a tax code for rich people and white people and then another tax code for people who are experiencing economic insecurity.”

The additional revenue would be used to pay for the growing expense of the state’s Blueprint for Maryland education plan. Working families would benefit from an expanded child tax credit that advocates say would cost $406 million.

“We know what works to build a vibrant economy: a well-educated workforce, which starts with good public schools; transit and road networks that help people and goods get to their jobs and to market; communities with affordable housing options so that people of all income levels can live where they work; affordable childcare so that parents can fully participate in the workforce; and families having enough money to afford what they need,” said Benjamin Orr, president and CEO of the Maryland Center on Economic Policy. “The Fair Share for Maryland Act, will provide the resources that help get us there.”

The bill would also raise $576 million through what the group called “corporate tax loopholes,” including imposing combined reporting on corporate earnings.

Combined reporting legislation has been proposed in previous years. In earlier versions, the bill called for combined reporting of companies and subsidiaries in the U.S.

Combined reporting is a system in which a corporation and its subsidiaries are counted as a single entity for tax purposes. The method prevents corporations from moving profits from one state to another or to another country with a lower tax rate.

Benjamin Orr, president and CEO of the Maryland Center on Economic Policy. Photo by Bryan P. Sears.

Orr said Maryland is in a minority of states that have not imposed some form of combined reporting.

The proposal, yet to be introduced in Maryland, would take it a step further.

Advocates said this year’s bill would impose the tax based on corporate earnings worldwide, rather than just in the U.S. If passed, Maryland would become the first state in the country to adopt such a standard.

Maryland faces significant fiscal challenges over the next five years.

Legislative budget analysts told lawmakers this week that Moore’s budget does little to resolve structural deficits in the coming year. Next year, the deficit is projected to reach $1 billion. In fiscal 2027, the last year of Moore’s term, it would grow to $1.3 billion. A year later, it would more than double to $3 billion — about 12% of the general fund revenues projected for that year.

Analysts said the deficit projections are the largest since the Great Recession.

“Generally, we haven’t seen that kind of gap except for during periods of recession or shortly after a recession,” David Romans, an analyst for the Department of Legislative Services, told the House Appropriations and Senate Budget and Taxation Committees. “So, it’s a particularly large challenge given that we are not coming out of recession or are in the midst of one right now.”

Transportation Secretary Paul Wiedefeld announced in December the need to cut $3.3 billion in projects over a six-year period beginning in fiscal 2025.

Wiedefeld and Gov. Wes Moore (D) announced $150 million in funding to pay for a one-year reprieve. The temporary fix leaves more than $3.1 billion in cuts looming, starting in fiscal 2026.

The Transportation Revenue and Infrastructure Needs Commission made initial recommendations to bolster the Transportation Trust Fund. The 31-member blue-ribbon panel continues its work this year. A set of final recommendations is due before the 2025 legislative session.

The bill faces challenges as Moore and Senate President Bill Ferguson (D-Baltimore City) have each expressed reluctance to seek new or higher taxes this year.

House Speaker Adrienne A. Jones (D-Baltimore County) was not immediately available for comment.

In recent weeks, House Appropriations Chair Ben Barnes (D-Prince George’s and Anne Arundel) has signaled interest in tax increases this session to help offset projected operating and transportation budget deficits.

A spokesperson for Ferguson said the Senate leader is not looking at tax increases in the current session.

Ferguson previously rejected the prospect of tax increases this year for transportation projects.

Other than Hettleman, no other senators, including leaders of the Budget and Taxation Committee, attended the press briefing.

Moore has expressed reluctance to impose tax increases in general.

Gov. Wes Moore (D) introduced his $63.1 budget for fiscal 2025 that contains no tax increases. Photo by Bryan P. Sears.

Advocates say that, when parsed, Moore’s comments do not foreclose support for the right kind of tax increase that does not hurt working families.

The governor has previously expressed, as far back as the campaign, an interest in expanding the Child Tax Credit and “closing loopholes for larger corporations.”

Carter Elliott, a Moore spokesperson, said Thursday that the governor wants to accomplish his policy objectives this session “without raising taxes on Marylanders.”

“Any conversation with the General Assembly around taxes is going to have a very high bar for the governor, and any of those conversations will focus on creating fiscally disciplined ways of making Maryland’s economy grow,” Elliott said. “Governor Moore looks forward to continuing ongoing conversations with the Senate President, the Speaker of the House, legislators, and stakeholders to create solutions that don’t add further burdens to Maryland’s working families.”

Creative Commons Attribution

Creative Commons Attribution