Advocates: A Maryland Community Reinvestment Act needed to invest in underserved communities

President Joe Biden proclaimed June as National Homeownership Month to recognize that owning a home is one of the greatest stepping stones to raising a family, building equity and securing generational wealth.

“I call upon the people of this Nation to safeguard the American Dream by ensuring that everyone has access to an affordable home in a community of their choice,” the president said in a statement.

Biden said his administration would crack down on discrimination that still exists in housing, despite passage of the Fair Housing Act of 1968.

Another statute passed by Congress in 1977 was the Community Reinvestment Act (CRA), which is meant to ensure banks and other financial institutions meet investment needs in the low- and moderate-income communities around them.

But two groups — Economic Action Maryland and the National Community Reinvestment Coalition — released reports this month advocating for a statewide community reinvestment act in Maryland, that they say would help increase homeownership and other financial lending opportunities for residents and business owners, especially people of color.

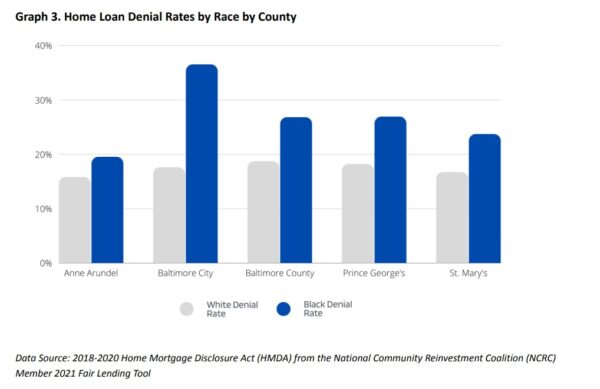

A graph showing denial home loan rates by race in five of the state’s counties. Photo courtesy of Economic Action Maryland.

Both groups and other housing advocates plan to push for the legislature to pass a bill next year.

Del. Melissa Wells (D-Baltimore City) introduced legislation this year to propose a state-level community reinvestment act, but withdrew it.

“There is some work I can do with the administration on it…to see what could be done through administrative action. I think there is some possibility of doing that,” Wells said in a brief interview. “I’m still very interested in the topic in making sure that [financial institutions] are meeting the CRA guidelines.”

Supporters of a state community reinvestment act say it would complement the federal act, which focuses on banks, and provide additional oversight to ensure people of color and low-to-moderate income communities aren’t overlooked.

Between 2018 and 2020 in Maryland, some statistics from Economic Action’s policy brief and a 20-page paper found:

- Black applicants were denied at all financial institutions at a rate 1.6 times higher than white applicants.

- Credit unions denied Black and Native American applicants slightly more than two times more frequently than white applicants.

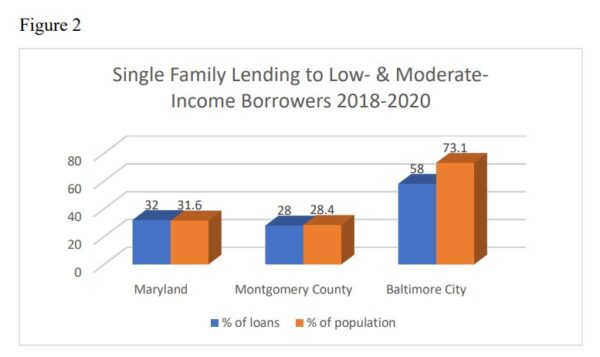

- Although Black residents account for 29% of the state’s population, about 20% received single-family loans. In Baltimore City, where the Black population was 62%, about 33% of those residents received those same loans.

- In Montgomery County, where the Latino population was 18%, about 10% of those residents received single-family loans.

A proposed statewide investment act would apply to about two dozen state-charted banks and seven credit unions that include Cecil Bank, EagleBank, Sandy Spring Bank, HAR-CO Credit Union and Post Office Credit Union of Maryland Inc.

According to the coalition, the state’s chartered banks have about $38 billion in assets and the credit unions almost $8 billion. The top 10 independent mortgage companies issued nearly 68,000 home purchase loans in Maryland between 2018 through 2020.

A graph highlighting single-family lending based to low-to-moderate income borrowers. Photo courtesy of National Community Reinvestment Coalition.

“Even though there’s a federal CRA, we believe that a state law in Maryland will increase reinvestment and lending in traditionally underserved communities,” said Josh Silver, a senior fellow at the National Community Reinvestment Coalition and author of the coalition’s study. “We would like to expand CRA beyond banks to include mortgage companies and credit unions.”

As a way to entice banks and credits unions to locate in those areas, Gov. Wes Moore (D) signed House Bill 548/Senate Bill 550, The Access to Banking Act, into law last month. The law, scheduled to go into effect July 1, would create financial incentives for financial institutions that locate in low- and moderate-income communities and provide businesses there with access to capital, funding and other financial services.

‘A missed opportunity’

The federal act assesses banks’ local investments by metropolitan statistical areas, or MSAs.

But those areas can cover vast areas and even stretch across state lines. For instance, Anne Arundel, Baltimore, Carroll, Harford, Howard and Queen Anne’s counties and the city of Baltimore are part of the Baltimore-Columbia-Towson MSA.

Because of that, Economic Action Maryland and the coalition claim banks can combine data that don’t show how financial institutions are performing on a more local level. In addition, they say federal regulators give at least 90% of banks a “satisfactory” grade. The top rating is “outstanding” and below satisfactory are “needs to improve” and “substantial noncompliance.”

Marceline White, executive director for Economic Action Maryland, said a statewide CRA would assess bank performance in each of the state’s 23 counties and Baltimore City. The proposal suggests that the state’s Office of the Commissioner of Financial Regulation, which is part of the state’s Department of Labor, could conduct the assessments.

A statewide act would also attempt to determine whether people of color receive the same opportunities as white residents to take out loans for homeownership, refinancing and other financial services. The evaluations would include those who reside in low-income communities.

According to the organizations, four states established reinvestment acts that include credit unions and mortgage companies: Connecticut, Illinois, Massachusetts and New York.

“Mortgage companies and credit unions make 55% of home loans in parts of Maryland and they’re not required to reinvest in communities in the same way that banks are,” White said. “I think that’s a real missed opportunity.”

In terms of credit unions, the state has about 70 with more than two million members.

John Bratsakis, president and CEO of the MD|DC Credit Union Association, said those financial institutions provide a variety of services such as financial counseling and homeownership classes. Employees also visit schools to teach youth financial literacy.

Bratsakis said only a handful of states have passed community reinvestment acts because credit unions follow the federal guidelines to serve not only local communities, but members also can receive lower rates for loans, lower fees and higher rates for deposits.

“Credit unions don’t need to be regulated to do this,” he said. “Credit unions are very focused on financial literacy and counseling and working with their membership to make sure that they’re prepared and armed with the information to improve their financial well-being.”

Creative Commons Attribution

Creative Commons Attribution