Although Maryland is one of the most diverse states in the nation, advocates say geographical and racial bias remains within the state’s housing industry.

Robyn Dorsey, fair housing director for Economic Action Maryland, said Bank of America represents Baltimore City’s largest depositor of funds at 43%. However, it has invested less than 4% in home purchase mortgages.

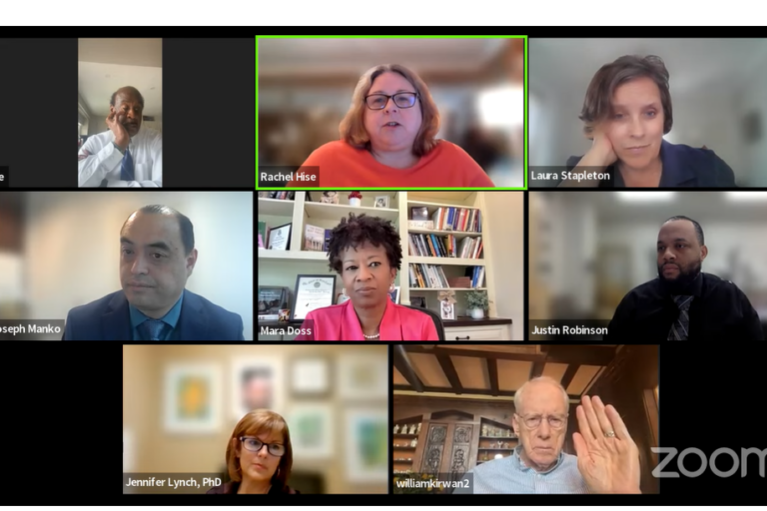

“That’s a lot of our city’s money going somewhere else, instead of being reinvested here in the city, [or] in areas around the city,” she said Thursday during an online housing forum hosted by the Maryland Commission on Civil Rights, an independent agency that enforces anti-discrimination laws and oversees discrimination cases involving housing, public accommodations, employment and state contracts.

Dorsey told the more than 100 people who logged online that her organization plans to advocate for a bill to be reintroduced during next year’s legislative session for the state to establish a Community Reinvestment Act. Del. Melissa Wells (D-Baltimore City) introduced the bill this year, but later withdrew it.

Although the federal government has a similar act, Dorsey said this proposal would include not only banks, but also mortgage companies and credit unions to assess racial equity components and their service in all 24 Maryland jurisdictions. Wells’ bill filed in the recent legislative session would’ve evaluated whether financial institutions meet “the convenience and needs of communities [that] include the availability of credit, depository services and other financial products.”

Participating in the forum were about a dozen other speakers who are realtors, lenders and appraisers.

The civil rights commission supported several bills that won approval in the recent legislative session including House Bill 669/Senate Bill 455. If signed by Gov. Wes Moore (D), it will alter qualifications for individuals to become real estate appraisers so that they would qualify for licensure by completing 1,500 hours of training or receive certification through a program called PAREA (Practical Applications of Real Estate Appraisal). Currently, licensure requires 1,000 hours of training and certification requires 1,500 hours of training, in both cases under the supervision of a certified real estate appraiser.

Jason Cohen-Perkins, who became deputy secretary for the state’s Department of Labor last month, praised the appraisal program as a way to get more people involved in the industry.

“We want to be the state that has actually made a meaningful difference,” he said.

Appraisal bias was a major topic in the afternoon session.

A report by the Brookings Institution showed owner-occupied homes in Black neighborhoods were undervalued by an average of $48,000, which amounted to $156 million in losses.

Several housing officials said one major problem is that appraisers are mostly white men.

Heather Sullivan, a member of The Appraisal Foundation’s standards board, which prepares draft reports on the industry for federal and state regulators, said lenders should review their policies and support diversity initiatives.

The foundation, she said, created a PAREA curriculum that targets students of color, veterans and those interested in working in underserved communities.

Outreach is also underway at historically Black colleges and universities, women’s and tribal colleges and other diverse institutions. Several predominantly white institutions — such as Old Dominion University, Virginia Commonwealth University and Temple University — already offer real estate-related classes that can count toward hours required for licensure.

“You don’t have to be chosen to come into the industry. You have a path forward on your own initiative,” said Sullivan, head of operations training programs for Aloft, a real estate appraisal business, based in Kirkland, Washington.

The commission held the forum, entitled “Closing the Gap on Racial Disparities in Housing,” in conjunction with April being Fair Housing Awareness Month. The month also marks the 55th anniversary of the passage of the Fair Housing Act that made housing discrimination unlawful.

But the forum presented some alarming statistics including that 35% of white households have incomes at or above $100,000; versus 20% Black of households.

Disparities continued in the national homeownership rate by race two years ago: whites at 72%, Asians at 62%, Latinos at 51% and Blacks at 43%.

“I think the message that we have heard throughout all of the presentations…is that there is an incredible amount of work yet to be done,” said Alvin Gillard, executive director of the commission.

Creative Commons Attribution

Creative Commons Attribution