U.S. House Democrats send sweeping climate, health and tax legislation to Biden

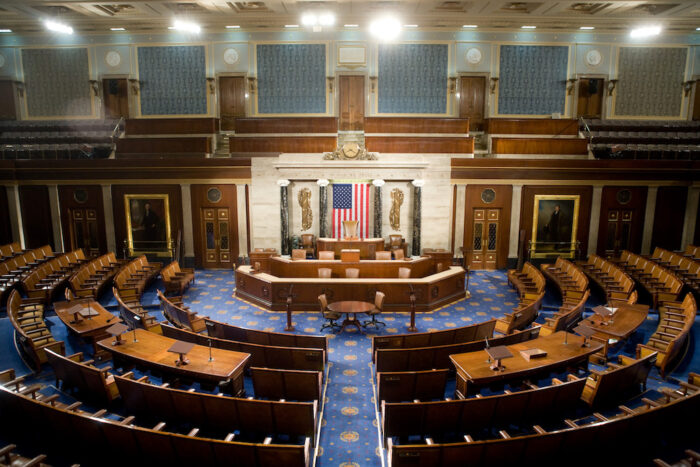

The U.S. House on Friday cleared Democrats’ long-sought climate, health care and tax package, sending it to President Biden for his signature. The president said Friday night that he plans to sign the legislation next week.

The roughly $750 billion measure is much smaller than the $2 trillion reconciliation package the House originally sent to the Senate in November. The final product left out dozens of provisions, including expanded child care tax credits and paid family leave, that many left-leaning Democrats believe are desperately needed.

But Democrats, including progressives, still championed the slimmed-down version of the bill before voting 220-207 along party lines to approve the package.

Debate on the bill Friday was part of a brief, one-day session for House members, who now will continue their August recess. Members aren’t expected to return to Washington, D.C., until Sept. 13.

Democrats repeatedly called the legislation “historic” and said it showed their party putting “people above politics.” The package would cap out-of-pocket expenses for Medicare prescription drugs at $2,000 annually beginning in 2025 and allow the federal government to negotiate some of the more expensive prescription drugs starting in 2026.

“This is landmark legislation that is going to help reduce costs for American families, while finally aggressively tackling the climate crisis,” Energy and Commerce Committee Chair Frank Pallone Jr., a New Jersey Democrat, said during floor debate.

“We simply cannot wait any longer to confront the climate crisis,” he said. “Extreme weather events are becoming more frequent and more extreme … and these extreme weather events cost families their loved ones, their homes and their livelihoods.”

Several Maryland Democrats released statements hailing the package.

“The Inflation Reduction Act is what Democrats are all about: lowering the cost of health care, standing up to the biggest corporations ripping off everyday Americans, and tackling the climate crisis with the fierce urgency of now,” said Rep. Kweisi Mfume (D-Md.). “I’m proud to support this historic legislation that puts people over politics and money back into the pockets of my constituents in Baltimore.”

Rep. Dutch Ruppersberger (D-Md.) also cast the vote as a triumph for average Marylanders over powerful special interests.

“For too long, tech and drug moguls have built their fortunes on the backs of middle class families who are now struggling with rising costs amid global inflation,” he said. “Now more than ever, we need billionaires to pay their fair share. Not one middle class family or small business will find themselves with higher taxes because of this bill – not one. Instead, this bill sets families and seniors up for lower healthcare costs, smaller utility bills and, ultimately, economic stability as a nation.”

GOP slams IRS funding

Republicans remained steadfastly opposed to the measure, dubbed the Inflation Reduction Act, saying it would raise the costs of energy and boost the number of Internal Revenue Service employees. The package would provide about $80 billion in funding for the Internal Revenue Service to boost tax enforcement, a change that Democrats argued during debate Friday would not affect Americans making less than $400,000 annually.

Michigan Republican Rep. Fred Upton weighed in against the bill, saying that while he’s no stranger to working on bipartisan legislation, he simply couldn’t support the package Democrats brought to the floor Friday.

“Our economy is in a fragile state as we emerge from this pandemic,” Upton said. “We’ve seen decades-high inflation that is crushing Main Street and squeezing the middle class.”

House GOP Whip Steve Scalise, a Louisiana Republican, rebuked Democrats for advancing the bill, speaking out against the energy, climate, health care and tax provisions. He also chastised Democrats for including the $80 billion to bolster staff and technology at the Internal Revenue Service.

“Let’s talk about these 87,000 IRS agents. You think of just about any NFL stadium in America filled completely with new IRS agents. That’s right, more than doubling the size of the IRS,” Scalise said.

House Budget Chairman John Yarmuth, a Kentucky Democrat, called Republicans’ statements about the IRS hiring 87,000 new agents “nonsense” and noted that the current IRS commissioner has said the agency won’t increase audits on people making less than $400,000 annually.

“It seems to me that Republicans just don’t want people to pay taxes, even if they’re owed,” Yarmuth said, noting that hundreds of billions of dollars in owed taxes go unpaid every year.

“This is an attempt to try to recover some of that money that is owed and is not being paid by taxpayers, who are in many cases cheating,” Yarmuth added.

On Twitter, Rep. Andy Harris, the lone Republican in Maryland’s congressional delegation, criticized both the process and the product.

“When this 750 billion dollar bill was brought to the House Floor, Republicans were not allowed to offer amendments or given enough time to show how bad this bill really is,” he wrote. “When we say we need a new speaker and new majority, this is what we are talking about.”

Swifter House action

House debate on the measure was nowhere near as long or tedious as it was in the U.S. Senate, where members spent Saturday night into Sunday debating 37 amendments before voting 51-50, with Vice President Kamala Harris breaking the tie, to approve the package on Aug. 7.

The bill, primarily negotiated by Senate Majority Leader Chuck Schumer and West Virginia Sen. Joe Manchin III, would dedicate $370 billion to clean energy programs, including electric vehicle tax credits and tax incentives for energy companies to produce renewable energy.

It would provide $1.5 billion to the Environmental Protection Agency to help companies reduce methane, a greenhouse gas, and would impose a fee on companies for certain methane emissions.

As part of the deal with Manchin, the legislation requires the U.S. government to lease 2 million acres of federal land and 60 million acres of federal waters for oil and gas development in order to lease other federal lands and waters for solar or wind production.

The bill would boost funding for a federal trust fund that helps coal miners diagnosed with black lung pay for their health care if the company they worked for doesn’t do so.

In other health provisions, the package would require pharmaceutical companies to pay rebates if they raise the cost of some prescription drugs within Medicare faster than inflation.

It would extend subsidies for three years for individuals who purchase health insurance as part of the Affordable Care Act, or Obamacare, to stave off a price hike that was expected to begin at the end of the year. Those enhanced subsidies were first approved as part of Democrats’ COVID-19 bill last year and were set to expire.

Insulin cap in Medicare

The measure would cap the cost of insulin for Medicare recipients at $35, but wouldn’t apply a similar cap on co-pays for people with private health insurance after Republicans in the U.S. Senate successfully blocked that provision.

House Democratic Whip Jim Clyburn, a South Carolina Democrat, said he was “especially pleased” with the bill’s insulin provisions.

“Having experienced my late wife’s 30-year battle with diabetes, I’m especially pleased that this bill would cap insulin costs at $35 a month for those on Medicare,” Clyburn said. “This is a giant step forward, but we will continue to work to overcome the Republican opposition that blocked extending the same life-saving measures to those on private insurance.”

The bill would be fully paid for by instituting a 15% minimum tax on corporations with incomes more than $1 billion and a 1% excise tax on stock buybacks as well as by allowing Medicare to negotiate some prescription drug prices.

Democrats advanced the measure through the 50-50 Senate and the narrowly divided U.S. House by using the budget reconciliation process, a complicated path that requires the bill to comply with several rules.

Democrats used the same legislative process to approve their $1.9 trillion COVID-19 relief package last year. Republicans used budget reconciliation to pass their 2017 tax bill. And the GOP tried to use it to repeal and replace Obamacare the same year, but didn’t have the votes in the Senate to pass their proposal.

Congress has used the process to enact 22 laws since 1980, according to the Congressional Research Service.

Josh Kurtz contributed to this report.

Creative Commons Attribution

Creative Commons Attribution