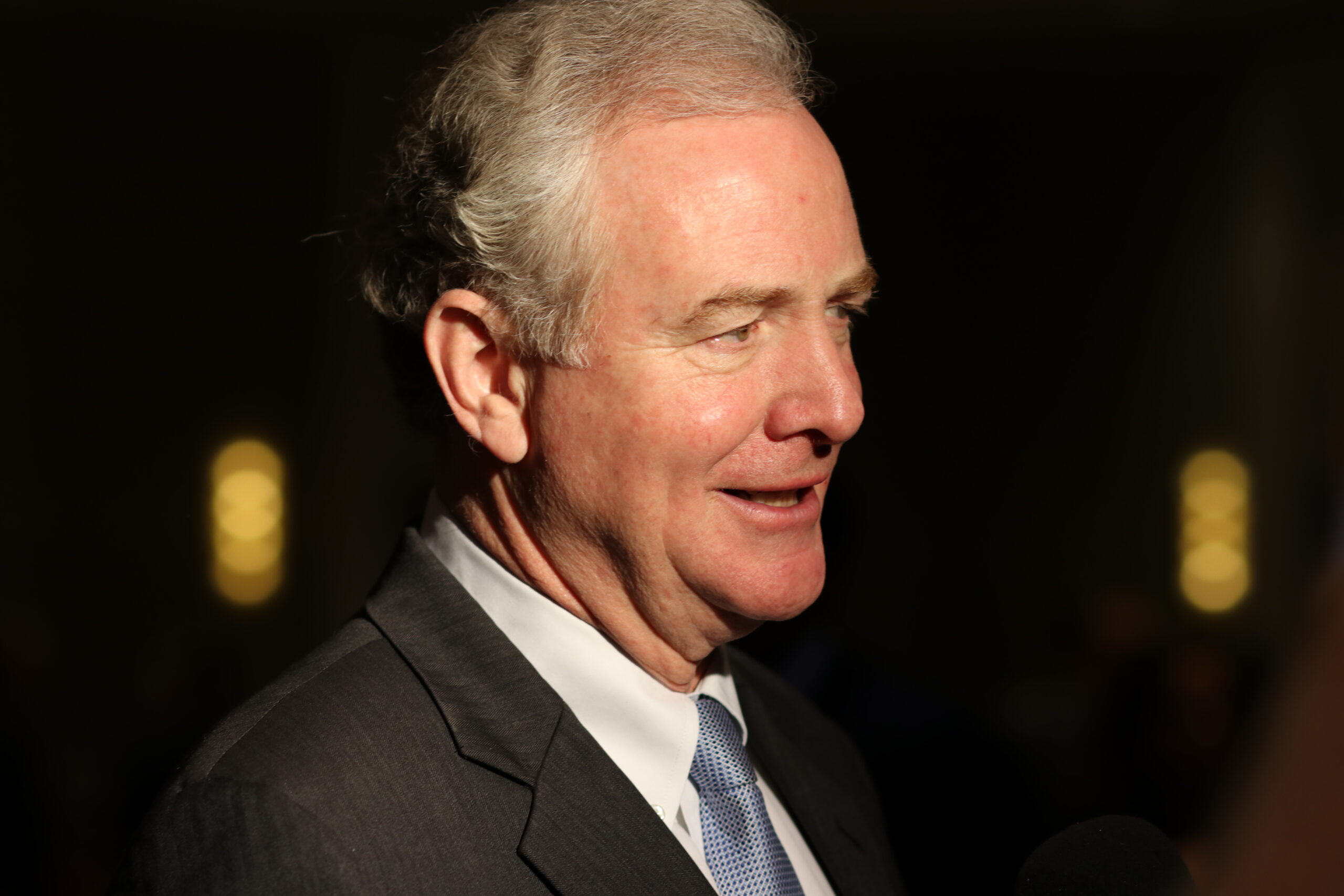

Van Hollen Continues Call for Student Loan Forgiveness, Seeks Details on Dept. of Ed’s ‘Fresh Start’ Plan

U.S. Sen. Chris Van Hollen (D-Md.) joined a coalition of progressive lawmakers in signing a letter to the U.S. Department of Education, requesting details about a plan to give student loan borrowers a “fresh start” before collections resume in August.

The letter, signed by Van Hollen, Sen. Elizabeth Warren (D-Mass.), Sen. Raphael Warnock (D-Ga.), Sen. Cory Booker (D-N.J.), Sen. Richard Blumenthal (D-Conn.), Sen. Tammy Baldwin (D-Wis.), Sen. Dick Durbin (D-Ill.) and Sen. Bernie Sanders (I-Vt.), requests that the department answer a series of questions regarding the implementation of its “fresh start” plan by May 5.

The moratorium on federal student loan collections ends in August 2022. The Department of Education announced earlier this month that the fresh start effort would eliminate the impact of delinquency and allow borrowers to reenter repayment in good standing.

“This move … has the potential to provide significant relief to millions of borrowers, particularly those who have most struggled with repaying their loans,” the lawmakers wrote. “We now write to request further detail about the steps ED intends to take to implement this plan and protect borrowers who have been in default for an extended period of time.”

According to the letter sent to Secretary of Education Miguel Cardona, more than 7 million borrowers are in default on their federal student loans.

An overwhelming number of those experiencing student loan debt are low-income, Black or Brown people, veterans, first-generation college students, disabled borrowers, parents and people who never finished their degree.

“Removing these borrowers from default when student loan payments and collections resume means that millions will not be immediately subject to wage garnishment, tax refund withholding, and aggressive collections practices that threaten to undermine their economic security,” the senators wrote.

Some borrowers in default have been repaying their debts for years.

According to a news release, more than 2 million people who were in default or at least 91 days delinquent on payments at the end of 2019 had been repaying their federal loans for at least two decades.

The senators argue that, under the Higher Education Act of 1965, the Department of Education has the ability to automatically remove default status for people with federally managed loans or to fully discharge cases of long-term default.

Additionally, lawmakers said that enforcing the Federal Claims Collections Standards, which allows agencies to compromise debts if those who owe cannot repay “the full amount due in a reasonable time … or the cost of collecting the debt does not justify the enforced collection of the full amount,” could provide additional relief.

The Washington Post also reported on Tuesday that President Joe Biden (D) may be willing to continue to push the moratorium back and could even warm up to the idea of canceling some of the debt through executive action.

This isn’t Van Hollen’s first attempt to alleviate the strain put on borrowers.

In April 2021, he signed a letter penned by Warren and Warnock requesting that the Department of Education remove all federally managed borrowers from default.

Van Hollen and the coalition of lawmakers joined forces again in November 2021 to ask Cardona to relieve student loan borrowers of federally managed loans of their default status, and craft a debt discharge policy for those who have been in default for a long time.

“Given that all defaulted borrowers have satisfied the statutory requirements for rehabilitation, the Department should automatically rehabilitate all federally-managed student loans without the need for application and develop a policy for discharge of debt for borrowers who have been in default for an extended period of time,” they wrote late last year.

Creative Commons Attribution

Creative Commons Attribution