House Leaders Unveil Package to Slash Sales Taxes, Expand Federal Work Opportunity Tax Credit

Top House leaders said Friday they will focus on bringing a $300 million tax relief package that would slash taxes on hygiene products and medical devices, as well as extend a tax credit to chronically underemployed Marylanders, to the House floor as quickly as possible.

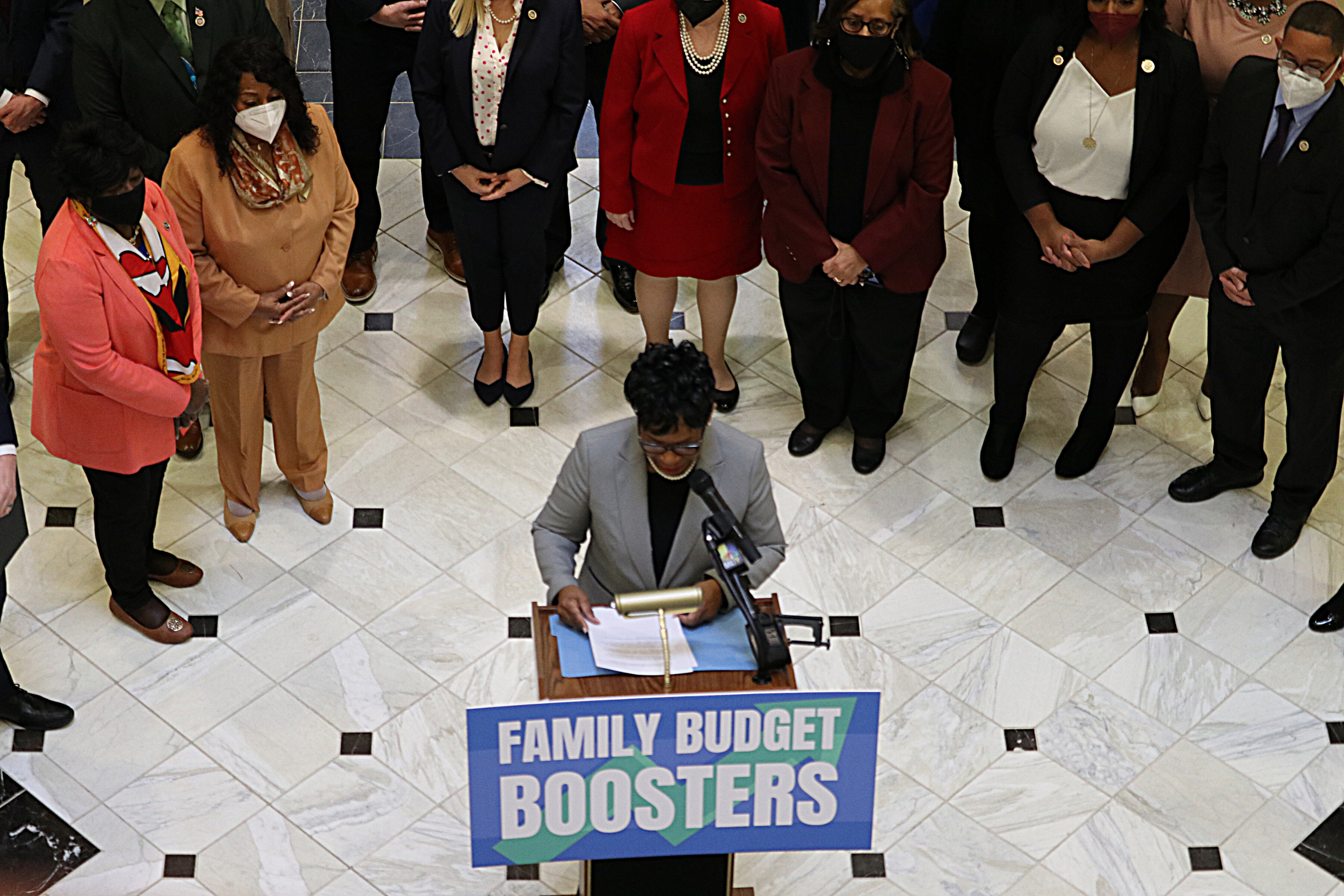

House Speaker Adrienne A. Jones (D-Baltimore County) said the package of “family budget boosters” is the next step in her chamber’s commitment to focusing on bills critical to those being left behind in Maryland’s post-pandemic recovery.

“Parents shouldn’t have to decide between buying diapers or new toothbrushes for the family. People shouldn’t have to worry if they can afford next month’s diabetes test strips. Far too often Marylanders — particularly those with young children and those who are older — have to make these difficult decisions,” Jones said. “This package will help give working families and those most in need a critical boost to their budgets, and it will also help put more Marylanders back to work.”

The package, which the Democratic lawmakers estimated would save Marylanders $300 million over the next five years, brings together and prioritizes several bills already introduced this legislative session.

House Bill 282, sponsored by Dels. Dana C. Jones (D-Anne Arundel) and Brian M. Crosby (D-St. Mary’s), would create a sales tax exemption on diapers. House Bill 288, also sponsored by the pair, would exempt baby bottles, baby bottle nipples, and infant car seats from the state’s sales tax.

House Bill 492 from Del. Steven C. Johnson (D-Harford) would remove the state sales tax on oral hygiene products like toothbrushes and toothpaste.

House Bill 1151 from Dels. Alonzo T. Washington and Julian Ivey (both D-Prince George’s) would exempt diabetic care products from the sales and use tax.

House Bill 364 from Del. Shaneka T. Henson (D-Anne Arundel) would add now-critical medical devices to the state’s sales tax exemptions, including thermometers, pulse oximeters and blood pressure monitors. An amendment is expected to add certain face masks to the list.

Combined, the measures are expected to reduce sales tax revenue by more than $20 million annually, according to fiscal analyses.

The largest part of the proposal is House Bill 2, from House Majority Leader Eric G. Luedtke (D-Montgomery). That bill would create a Maryland state match for the federal Work Opportunity Tax Credit, which incentivizes employers to hire workers who have trouble finding work, including veterans, people with disabilities, the long-term unemployed, those on state financial assistance programs, and people who have completed terms of incarceration.

In the first year of employment, employers can claim a credit equal to 40% of the first $6,000 of wages paid to an employee who is among the groups targeted for employment opportunities. About 56,700 Maryland companies participated in the federal tax credit program last year, the Maryland Department of Labor told legislative analysts.

The bill would reduce state revenue by an estimated $73 million in the first year due to credits claimed against income taxes, but Luedtke said savings would be realized elsewhere, including by putting people back to work and lowering the costs for state safety net programs.

“This program can change lives while paying for itself,” Luedtke said.

During a bill hearing in January, House Minority Leader Jason C. Buckel (R-Allegany) said the Hogan administration had submitted testimony indicating support for the program.

During this legislative session, Gov. Lawrence J. Hogan Jr. (R) has been pushing for his own tax relief package, which would phase out all taxes on retirement income over six years, and permanently extend the billion-dollar RELIEF Act that expanded earned income and child tax credits, which passed in the General Assembly as a bipartisan priority last year.

“It says a lot about how much we’ve changed the culture in Annapolis that Democrats are feeling the heat and proposing some tax relief of their own,” Hogan said in a statement Friday afternoon. “While this doesn’t come close to the $4.6 billion in tax relief we’ve proposed for families, small businesses, and retirees, we appreciate this effort and look forward to further bipartisan discussions.”

Luedtke said Friday that House lawmakers are “still very much in conversations with the governor about not only this package and their tax relief proposals, but also about the budget.”

The House, he said, is committed to bringing these bills to the floor in the next few weeks, and other provisions will likely be sorted out as budget negotiations continue. The deadline for the General Assembly to pass a fiscal year 2023 budget is March 30.

Creative Commons Attribution

Creative Commons Attribution