Hogan Introduces $58.2 Billion Budget, Including Tax Relief Proposals

Gov. Lawrence J. Hogan Jr. (R) released his final budget proposal on Wednesday, a $58.2 billion spending plan that increases state education funding, expands relief programs for Marylanders hit hardest by the pandemic, and — if the governor’s team sees legislative success — would steer tax relief to Maryland retirees.

“I can think of no better way to begin this last year than by presenting a budget which continues to keep the promises we made. And that builds on the bipartisan progress that we have achieved to change Maryland for the better,” Hogan said.

The budget is built on an unprecedented level of fund balances and revenue growth. And, in addition to a $2.4 billion appropriation to the state’s rainy day fund, it would leave the state with a $1.3 billion structural surplus going forward.

In October, Hogan committed to a “five-point plan” for spending the surplus, including increasing the state’s rainy day fund, providing tax breaks for retirees and working families, increasing relief programs for underserved Marylanders and enhancing state employee salaries and benefits.

The budget includes more than $850 million over the current and next fiscal year to give salary enhancements and bonuses for state employees.

Hogan said the budget would also boost electric and utility assistance for 160,000 households, enhance food benefits for 27,000 seniors and 50,000 children, and fully fund temporary disability assistance to help 11,300 Marylanders.

Hogan’s tax relief proposals would phase out all taxes on retirement income over six years, and permanently extend the billion-dollar RELIEF Act that expanded earned income and child tax credits, which passed in the General Assembly as a bipartisan priority last year.

House Appropriations Chair Maggie L. McIntosh (D-Baltimore City) said there might be more agreement between the legislative and executive branches on expansion of the earned income tax credit, though she said lawmakers might be inclined to take action once the existing expansion has been in place for longer.

Hogan’s budget does not include making the tax credit permanent for people who pay taxes using individual taxpayer identification numbers, which includes undocumented immigrants, certain survivors of domestic violence and student visa holders.

Republicans and Democrats disagreed on that issue in 2021, but the General Assembly ultimately passed legislation allowing ITIN filers to receive the credit for the 2020, 2021 and 2022 tax years.

On the retirees, Hogan’s plan would completely phase out taxation on all income of retirees, beginning with those who earn the least. Hogan said 70,000 retirees would qualify for relief under the first year of his plan.

“We have to see how much we can afford,” McIntosh said. “…This is something the governor has introduced every year. This may be a year when we can look at it differently.”

But, she cautioned, lawmakers will have to decide whether the state’s bounty – which has an unknown durability – would be best spent on that tax relief or other areas, like community college tuition for state high school graduates, a program that has been underfunded in the past, or any other number of legislative priorities that are already law.

McIntosh and Senate Budget and Taxation Chair Guy J. Guzzone (D-Howard) said lawmakers will also be digging into funding for the multibillion-dollar Blueprint for Maryland’s Future education reform program, which they said is not fully funded in the proposed budget. That includes a budget provision passed last year that aims to boost some of the state’s most underfunded school systems, Prince George’s County and Baltimore City, by $26 million and $99 million, respectively.

Hogan’s budget plan would allocate $8.15 billion to K-12 education, includes $144.4 million to expand full-day pre-K programs for 3- and 4-year-olds, and would provide an additional $50 million in child care stabilization grants to support providers dealing with impacts from COVID-19.

Guzzone and McIntosh agreed that there is room to find common ground on top legislative concerns.

“I think we’ll have a very good, productive discussion over the next few weeks and months,” Guzzone said. He suggested that one of the first priorities should be reviewing programs that already exist in state government but have been underfunded in the past, particularly within the Department of Health.

Lawmakers were slowly taking in the budget proposal on Wednesday. The governor’s fiscal year 2023 spending proposal is more than $8 billion higher than the initial expenditures he proposed in last year’s budget, though that figure grew as federal stimulus funds started to flow and Maryland’s economy improved.

“Because of the magnitude of it all and all the moving parts, it’s a lot to absorb on the first day,” Guzzone said, after an initial briefing from the Department of Budget and Management.

Fiscal committees are expected to get a more in-depth briefing from legislative analysts on Monday.

House Speaker Adrienne A. Jones (D-Baltimore County) said in a statement that she was disappointed that Hogan’s budget proposal didn’t fully fund the Blueprint reforms and that she was skeptical it would do enough to “address historic state staffing shortages that put Marylanders at risk every day.”

“We look forward to working with the Governor and the Senate and will continue to ask, ‘Is this helping the families who’ve been left behind in post-pandemic recovery?’” Jones’ statement concluded.

Hogan pushes ‘re-fund the police initiative’

Other provisions included in Hogan’s budget would boost the state’s pension system, enhance cybersecurity programs, improve broadband infrastructure, fully fund Chesapeake Bay restoration efforts, fund Maryland’s park service at a 20-year-high level, dedicate nearly $1 billion to mental health and substance abuse programs, and direct more funding to local governments.

The budget also includes Hogan’s “Re-Fund the Police” initiative, which would direct more than $500 million over three years to state and local police agencies for salaries, benefits, crime prevention grants and other programs.

Hogan’s proposed $6.8 billion capital budget would dedicate $1 billion to school construction, $601 million to institutions of higher education, $181 million to maintenance and infrastructure at state parks and open spaces, and $3.3 billion for roads and mass transit.

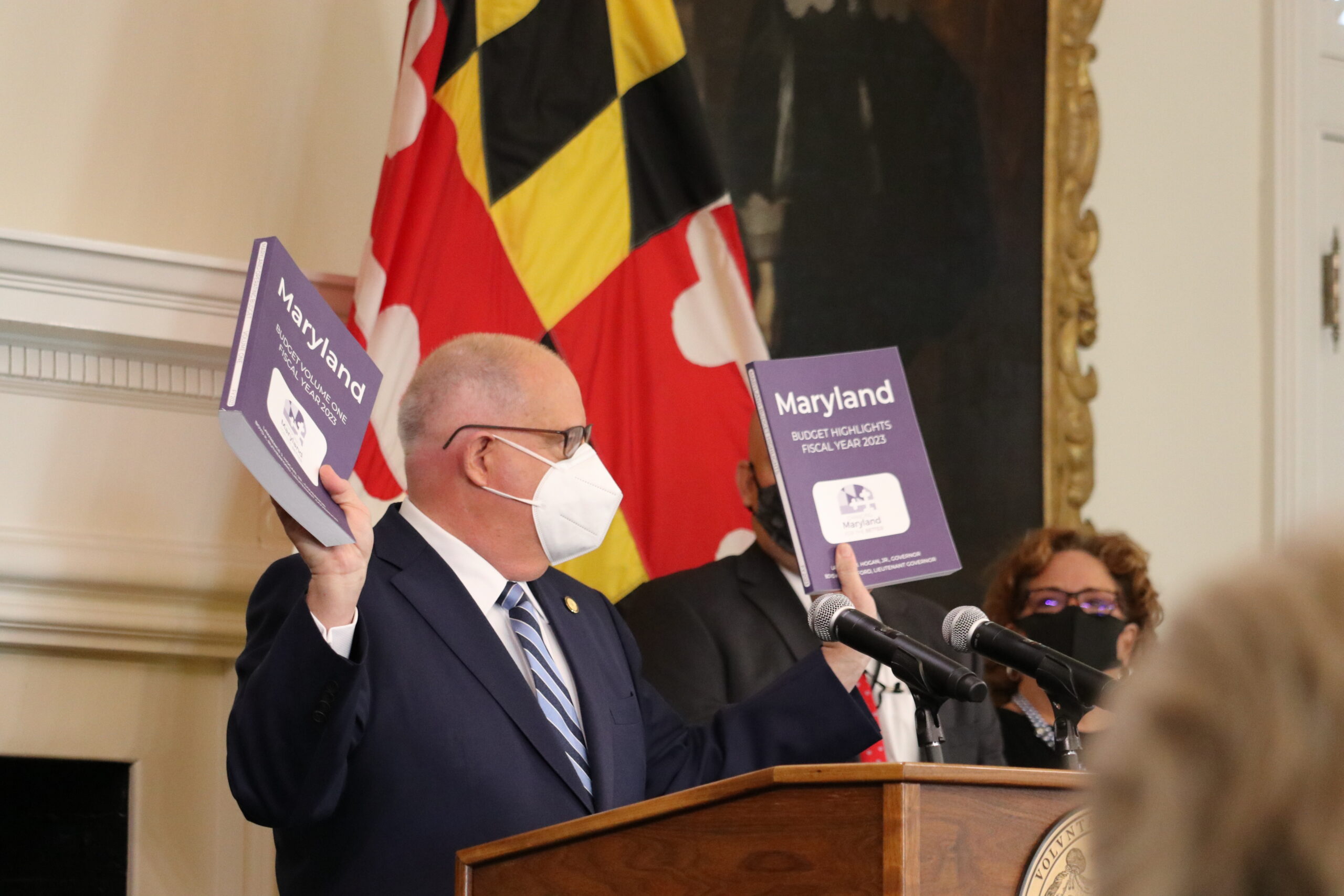

In a departure from years past, the Hogan administration’s printed budget books weren’t black, but rather a deep shade of purple. Hogan said it was symbolic.

“We just thought this is such a historic budget. We wanted to do this to symbolically show that it’s different,” Hogan said. “It really is a bipartisan effort.”

Creative Commons Attribution

Creative Commons Attribution