Opinion: Legislature, Governor Must Act Now to Protect Marylanders from Financial Adversity

Over the past few days, Americans and Marylanders have begun adapting to the challenges that a global pandemic brings with it in modern times.

While some active measures have been taken to alleviate the financial strain that everyday people will likely experience as their businesses and jobs suspend operations, much uncertainty remains. To that end, Maryland’s legislature should enact emergency legislation putting in place a 30-day automatic stay on all debt collection activities, with the ability of the governor to extend such a stay in 15-day increments until the General Assembly reconvenes next year (or perhaps earlier, should the governor call an emergency session).

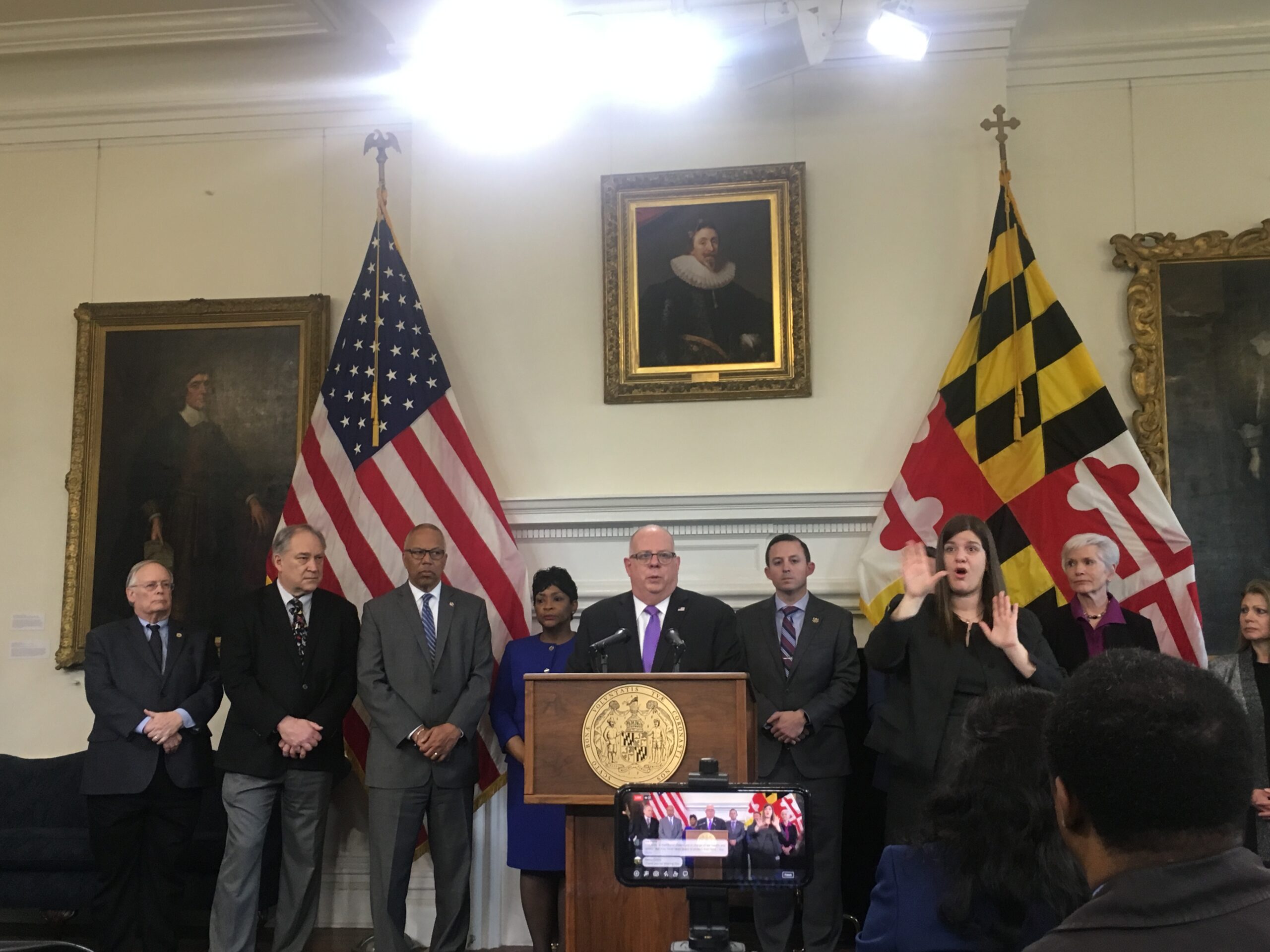

Here in Maryland, our governor acted swiftly to stem exposure to the disease and its spread by closing schools and banning all gatherings of more than 250 people.

Several counties have followed suit, closing down places where infections could spread easily such as libraries and community centers for the foreseeable future. Some major utilities and cyclical-billing businesses have made the right choice to not cut off service or harass customers who fall behind on their bills as a short-term economic downturn related to the virus outbreak seems inevitable.

Legal and judicial stays prohibiting debt collection are a well-established practice within the American legal system. Under bankruptcy law, debtors are granted an automatic stay against their creditors (read: they cannot even communicate with a debtor about a debt) for a minimum of 30 days, subject to extension as deemed necessary by the court. However, the protection given by bankruptcy is temporary, and the resulting havoc wrought upon an otherwise honest and decent person’s credit report, and their ability to financially recover is impacted for years to come.

During the 2008 financial crisis, lenders had nothing standing between them and their desire to seize the homes of Marylanders whose only crime often was that their job no longer existed, or their business had been ruined by the ripple effects caused by poor ethics on Wall Street. Public utilities shut off water and electricity to consumers behind by a pittance without mercy throughout the state, while extending generous terms for payment extensions to large businesses.

For a time under Gov. Martin O’Malley, Maryland became the Foreclosure Capital of America, and as late as 2017, our state remained in the top three for highest number of foreclosures. The Great Recession was perhaps Maryland’s greatest undeclared state of emergency in our 400-year history.

Some creditors and large businesses that rely on cyclical revenue (think: credit card companies, cell phone carriers, or even private trash collection) have announced leniency and common-sense steps to make sure their customers are not overburdened during the state of emergency caused by the COVID-19 pandemic. Our state courts have announced that for the next two weeks, they will only hear cases of extreme urgency (e.g. habeas corpus petitions, arraignments, etc.), to ensure that the constitutional duty that justice be served not be overturned.

But this does not mean that those who might incur financial hardship during the next 15 days will be allowed a fair chance to pay their past-due bills in a reasonable or morally responsible manner. Without a stay on debt collection in place, unscrupulous creditors and debt collectors might seek to benefit unethically (as many did previously during the Great Recession of 2008) by harassing Marylanders with adverse credit reporting, ceaseless communications to collect on debts, and, eventually, legal action. The only relief that Marylanders might have from such harassment would be the power of a stay legislated into law.

We must look beyond the immediate headlines and social media fervor surrounding COVID-19 and recognize that sound public policy lasts for the ages.

Rather than attempting to pass poorly thought-out tax increases on everyday services, Maryland’s state legislators would do well to create a mechanism through which our businesses and everyday citizens will be protected from adverse financial effects during times of national crisis. Creating the power for staying debt collection as necessary through an act of law would achieve exactly that.

— HAMZA KHAN

The writer is the executive director of The Pluralism Project, a political organization committed to researching progressive legislative solutions and electing Americans from diverse narratives to public office. He lives in Potomac.

Creative Commons Attribution

Creative Commons Attribution