An unintended generational competition for nonexistent state resources is underway in Maryland, in which tots and teenagers are forced to contend with senior citizens for billions of dollars in promissory money the state doesn’t have even as there are warnings of future structural deficits.

A secondary rivalry, as expected, is occurring between Republican Gov. Larry Hogan and the dominant Democratic General Assembly over who can deliver the pork chop to which constituency. Seniors vote. Kids don’t.

In other words, nobody knows where the buck stops, let alone where the bucks are.

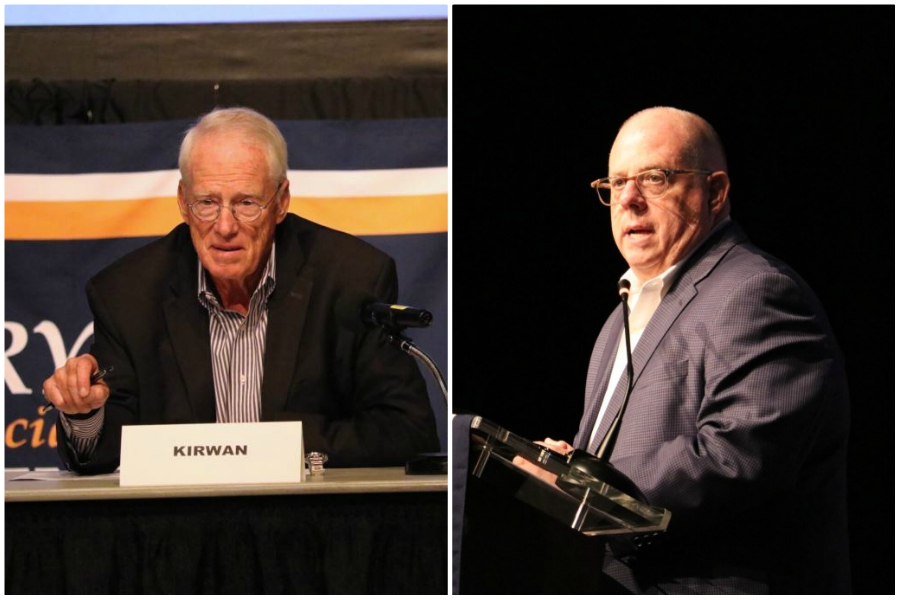

At one level, the legislature’s leadership has committed to scratching for $4 billion a year, now and for the future, to fund the Kirwan education program, which will take care of the kids. The program is supposed to make Maryland’s schools “the envy of the world,” according to its namesake, Brit Kirwan, former chancellor of the state’s public higher education system.

To pay for the program, the Assembly must find a funding source, and right now lawmakers are fixated on taxing digital ads, since nearly everything else is already taxed, a dubious source from the start. It’s questionable whether a single state can take such action in what is essentially interstate, if not worldwide commerce. (Consider the fuss when France attempted a tax on Internet giants such as Google and Facebook.)

It’s important to remember, too, that the legislature can only cut the budget but cannot increase it. Nor can legislators shift money among programs.

What’s more, Kirwan is basically a bow-tied gift to two subdivisions, Baltimore City and Prince George’s County, neither of which can afford, so they say, to ante up their local shares under the joint funding formula. Prince George’s, tin cup in hand, is especially asking for help, if not to be excused from the local funding obligation as it’s currently envisioned.

Frank A. DeFilippo

There’s a jolt of insincerity in that request. Baltimore is taxed to the max, and still broke, for a variety of reasons. But Prince George’s has a tax cap and is unwilling, and by consent unable, to pay its fair share at the same time it likes to boast of being host to the wealthiest black enclave in America, Mitchellville. In Baltimore, six Zip codes support the entire city.

Elected officials have tried for years to either repeal or scoot around the property tax cap, but the good burghers in Prince George’s repeatedly resist the attempt. So the county is stuck with the cap. (Hogan’s father, Larry Hogan Sr., incidentally, ran for county executive as an anti-tax crusader in 1978, as did his son in 2014. Hogan Senior was the last Republican to serve as Prince George’s county executive.)

At the other level, Hogan has promised $1 billion in tax relief for senior citizens. He would like to eventually eliminate taxes on retirement income completely (whatever that means), but for now on incomes up to $50,000 a person will do as a way, he hopes, of keeping pensioners from abandoning the state.

There are a couple of deceptions under the shells of this game, too. First, to give Hogan credit, his budget has fully funded pre-K programs, which is a major plank of the Kirwan package. But he has no more discretionary money than the General Assembly, and to begin messing with the income tax is risky business. Hogan has already cut taxes on retirement income for first responders (and also eliminated a bunch of tolls and fees).

Maryland’s income tax is one among 44 states that peg their system to the federal income tax formula, as many homeowners discovered under the Trump tax cut package. It’s a guess, and probably a solid one, that there aren’t that many retirees in Maryland who actually pay income taxes on pension money, and if they do it’s not that significant.

But the image of those caravans of elderly folks fleeing Maryland is a powerful one, even if imaginary, like covered wagons heading west or the Okies fleeing the Dust Bowl during the Great Depression. This may be the biggest blooper of all in Hogan’s proposal. America is a nation on the move. People uproot and leave for a variety of reasons, and a major motivation for rheumy seniors is weather.

The one thing Maryland cannot do to retain retirees is replicate the Sunbelt climate. And Hogan surely can’t blockade the Delaware Turnpike if the elderly choose to live across the line to save sales tax on their gerontological purchases.

Recall, too, that this is the very same legislative crew that claimed it was unable to find $200 million to continue subsidizing state retirees’ prescription drug coverage but is now convinced it can scrounge $4 billion to pay for increases in education spending.

There are various programs that help retirees as well as others on fixed and moderate incomes. One is the Homeowners Tax Credit Program, which is designed to provide protection against huge increases in assessments. It is tied to income levels.

One problem is that the income caps haven’t been adjusted for nearly a quarter of a century while at the same time Social Security and other pension COLAs are tied to inflation and have increased dramatically over the years, putting many retirees at risk of losing the benefit, or more dramatically, their homes. The increases and caps are out of sync.

So while a duel of the generations plays out in Annapolis, on paper at least, the ministers of influence must scrape and scratch for funds to back up their promises.

Don’t forget about the racetrack deal

But wait! There’s another $400 million idea kicking around that has nothing to do with education or comforting the elderly.

That’s the price tag of resuscitating the ramshackle neighborhood around Pimlico Race Course in Baltimore, a scheme cooked up between the city and the track’s owners. It would buff up Laurel as the state’s premier racetrack and retain the Preakness as a one-day spectacle at Pimlico. The rest of the area would be a mixed blessing of housing, shopping and amusement venues.

So that’s another $400 million the plan’s sponsors must identify to support the sale of an equal amount of bonds by the Maryland Stadium Authority, which must still be guaranteed by the good faith and credit of the state.

Add to that yet another $2.2 billion in school construction funds that local governments would like to tack onto the tab of the Stadium Authority, so it’s fair to assume that the legislature might have found another shortcut around standard executive budgeting process by utilizing what amounts to a “shadow government.”

Hogan’s budget, as submitted, is $47.9 billion. Add to that another $5.4 billion that the governor would like to cut from the state’s revenue stream, and the Assembly would like to increase as its wish-list, and they’re talking about some serious money.

Legislative analysts have warned that even though Hogan has plugged the structural deficit for now, a new hole of $37 million will occur in a year or two.

It was last the major education reform program, Thornton, that helped to initiate the cycle of structural deficits along with a second foolhardy and self-serving act by then-Gov. Parris Glendening (D).

Glendening ordered the Thornton study and signed it into law without providing the funding, leaving the unpaid bill to his successor, Gov. Robert L. Ehrlich Jr. (R). Glendening also cut the income tax as an election-year gift to himself when nobody expected or demanded it. The twin actions left a huge hole in future budgets, a recurring headache that exists to this day.

Kids and seniors may be accidental pawns in a high-states proxy battle, but the more appropriate question is whether they’ve been cozened by that which is desirable but beyond the state’s means. The entire mishegas could be little more than a munificent gesture in a pauper’s will.

Creative Commons Attribution

Creative Commons Attribution