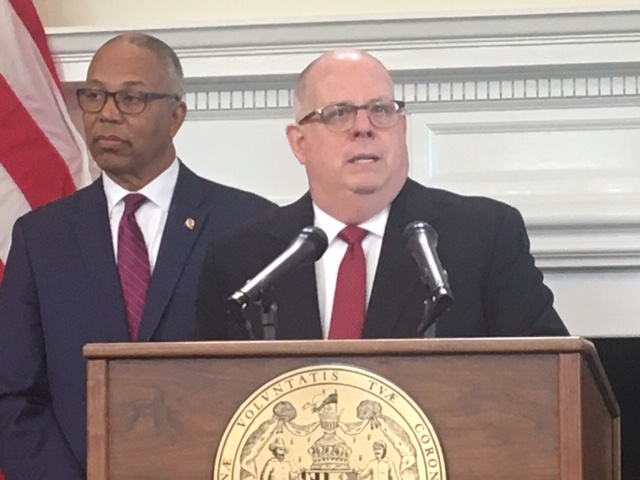

Hoping to shake Maryland from its perch as the “worst state in the nation” for retirement, Gov. Lawrence J. Hogan Jr. (R) said Thursday he will submit legislation to provide tax relief for retirees.

The Retirement Tax Reduction Act would provide more than $1 billion in tax relief over the next five years and would be the biggest reduction in state taxes in more than two decades, he told reporters.

The bill will be introduced on Friday, aides said. The text of the proposal was unavailable on Thursday afternoon.

Under Hogan’s proposal, retirees who earn less than $50,000 would pay no state income tax. Retirees who take in up to $100,000 would see their state tax burden cut by at least half.

The governor said he hears “nearly every day” from people who enjoy living in Maryland but “are moving to Delaware or South Carolina or Florida, where they won’t take so much out of their retirement checks.”

His proposal comes as state lawmakers search for billions of dollars to fund the educational reforms recommended by the Kirwan Commission.

Seniors are a potent voting bloc, but Hogan’s proposal is likely to face an uphill fight in the General Assembly.

“The interesting thing is the juxtaposition with Kirwan,” a senior legislator said. “What is he trying to say — ‘let’s make this even harder to make sure our schools are world class?’”

Asked by a reporter if his tax cut has a spending offset to make it revenue neutral, Hogan said the measure wouldn’t take effect for a year. That way, he said, lawmakers won’t be able to repurpose the savings he’s identified for other programs or priorities.

“We’ve made [that] mistake in the past,” he said. “They’ll not vote for it and then grab all the money. … We don’t have that shell game that we usually play with them where we put the money in for the tax cut and they take it and spend it on something else.”

Although he referenced a July 2019 CNBC report that identified Maryland as the least desirable state in the nation for retirees, tax burden was not explicitly listed among the five factors that produced the ranking.

The report, based on an internet post by bankrate.com, did include “affordability,” a composite of cost of living, the rate at which people in a state are priced out of health care, and levies on property, income and retail sales.

The other four factors were culture, “wellness,” crime and weather.

The administration’s bill — if approved by the General Assembly — would provide relief for more than 230,000 Marylanders, Hogan said, and “would keep tens of thousands of Maryland retirees from being forced to flee our state.”

Creative Commons Attribution

Creative Commons Attribution