Retirees Seek Class-Action Status in Prescription Benefits Case

More than 1,000 state retirees are seeking to be recognized as a class in a lawsuit against the state of Maryland over lost prescription drug benefits – and another 1,000 filings are on their way.

Certifying a class-action case would bring all retiree claims about the drug benefits into one courtroom, while “separate actions by individual members of the class would create a risk of inconsistent adjudications,” plaintiffs wrote in a memorandum filed with the U.S. District Court on Friday.

It is the latest development in Fitch, et al. v. State of Maryland, which was filed in 2018 and yielded an injunction that stopped a state reform from taking place this year. It would have removed Medicare-eligible retirees from a state plan and shifted them to the federal program.

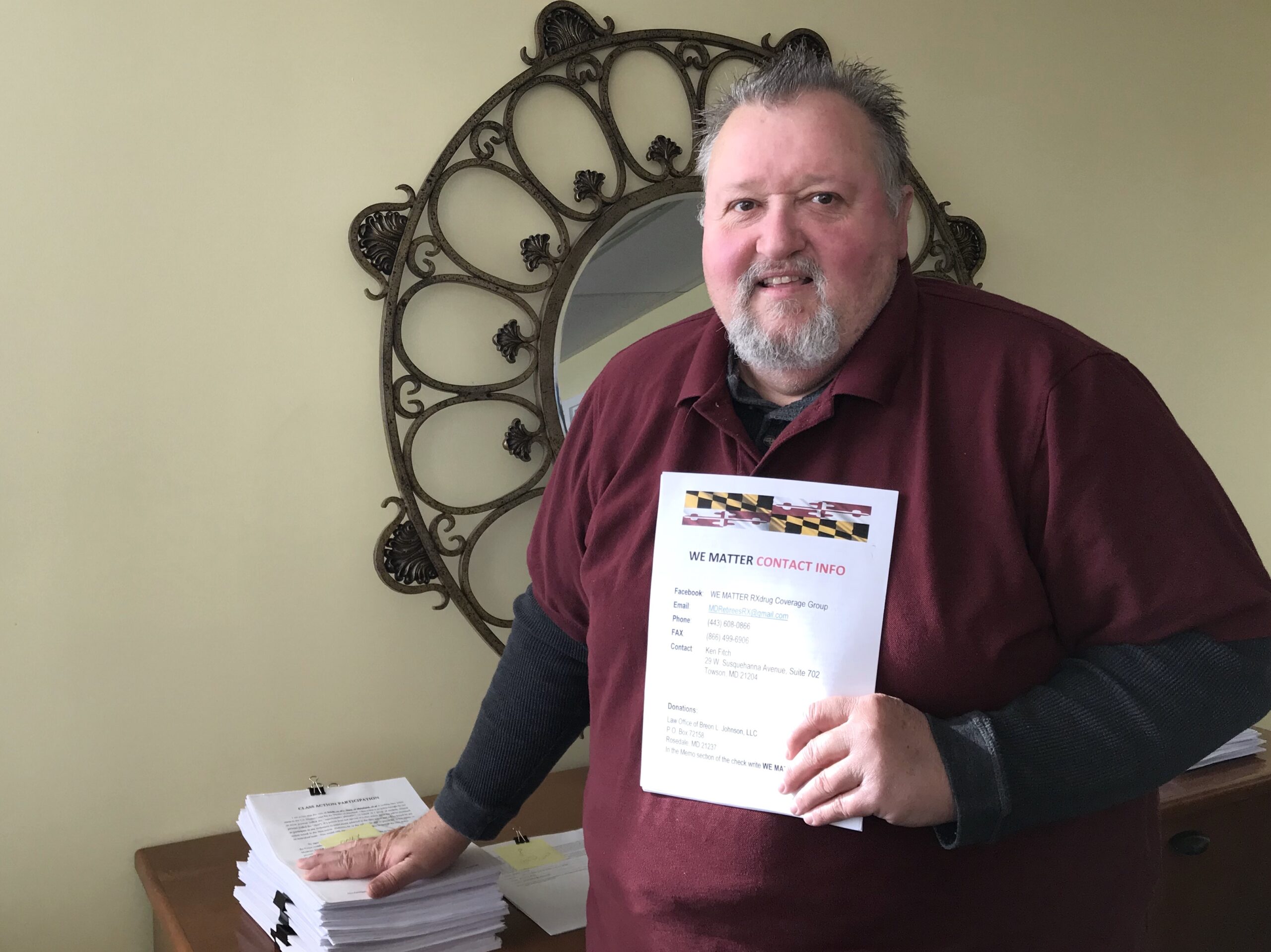

Lead plaintiff Kenneth Fitch and his attorney, Deborah A. Holloway Hill, have held meetings across the state to inform retirees about the change. They’ve collected thousands of forms from retirees who say they want to be part of a class-action case. The first 1,000 forms were delivered as part of a motion to certify retirees as a class, and another 1,000 forms are being processed now, Hill said Wednesday.

The state has so far not responded to the motion to certify a class-action claim and officials from the Office of the Attorney General and Department of Budget and Management declined to comment Wednesday.

The number of retirees or vested state employees who could be part of the case is estimated to be between 35,000 and 90,000 people, according to the plaintiffs’ filing.

The shift in retiree health benefits was in the works for several years, but only became widely known last spring, when thousands of retirees were mailed notices that they would need to enroll in Medicare. That stemmed from pension reform passed by the General Assembly in 2011, which lowered the state’s post-employment benefits liability by roughly $8 billion.

The plaintiffs’ lawsuit claims that pension benefits are a form of deferred compensation and constitute a property right, and that reducing the availability of a previously promised health benefit is unconstitutional.

“The promise and provision of certain guaranteed health benefits, which include prescription drug coverage, for the duration of their retirement, induced the Plaintiffs and all other similarly situated persons to continue working as a State of Maryland employee and forgo additional options and opportunities for employment and benefits from other employers,” Hill reiterated in Friday’s filing.

In response to outcry from retirees, the legislature passed a bill this year to update the retiree prescription drug program. That bill creates three plans to try to keep retirees “as whole as possible,” lawmakers said.

Under the bill, which passed into law last month without Republican Gov. Lawrence J. Hogan Jr.’s signature, those who retire before Dec. 31, 2019, would have access to a plan with an out-of-pocket expense cap at $1,500. Retirees after that date would have a cap of $2,500.

All retirees would have access to a life-sustaining prescription drug plan in which the state would pick up the costs for critical medications that are covered by the state’s current plan but not Medicare Part D. Lawmakers have tasked state government with creating a program that would provide instant or near-instant reimbursements to retirees after they pass the annual out-of-pocket cap. The bill will not take effect until the lawsuit is settled.

Hill and Fitch said the lawsuit to reinstate the previous benefit is necessary because a reimbursement-based program is not sufficient for retirees on a fixed income who might need expensive drugs to survive.

“Who has that kind of money to lay out?” Fitch asked about pricey prescriptions.

“They’ve eliminated that drug coverage – in a different way,” Hill said.

Fitch, who is diabetic, said he paid $930 in co-pays each year under the state prescription drug plan, a figure that would shoot up to an estimated $11,683.10 under a Medicare plan. The class-action forms that he’s collected include other tales of sticker shock, Fitch and Hill said.

Creative Commons Attribution

Creative Commons Attribution