Here we go again: The General Assembly took back $100 million that it had in hand to pay for senior state retirees’ prescription drugs. And it spent $2 billion that it doesn’t, and won’t, have on future education funding.

Gov. Larry Hogan (R) was absolutely correct. What all of those dollar signs mean is that a tax increase is a certainty even though he allowed the bill to become law without his signature. No governor wants to be against education. And no governor wants to author a tax increase.

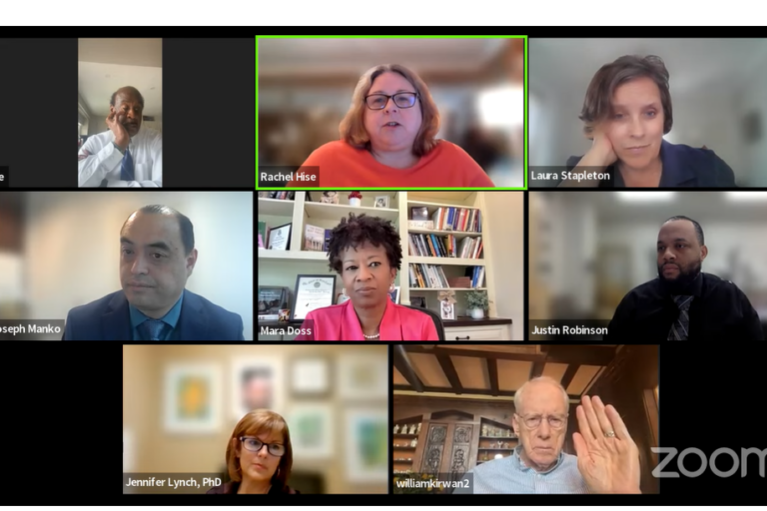

To put the dollar difference in perspective, the $100 million cost of drug coverage represents 0.217 percent of the state’s $47 billion budget. The $2 billion cost of the Kirwin Commission education funding advance would be 4.25 percent. That’s a difference of about 4 percent of the total budget.

The 48,000 state retirees who pay into the state’s prescription drug program are being dumped into Medicare Part D as the result of a back-room deal made during the O’Malley administration and ratified by the Hogan administration and the current General Assembly. A second purge was necessary after a ruling that termination of the retirees was illegal until the issue is resolved by the courts. Retirees had sued to block the dump.

It’s being done, we are told, to conform to new accounting standards that apply to pension funds and will cut the state’s future unfunded liabilities for drug coverage from $16 billion to $8 billion. (Future liabilities usually mean that if every member of the state pension system claimed every prescription drug available all at the same time and followed the actuarial tables, the system would be obligated for a $16 billion cash-call.)

This year, the Assembly threw a sop to retirees by approving a plan that will allow reimbursements when drug costs exceed certain levels. Nonetheless, the cost of Medicare Part D coverage is far greater to retirees than the state plan, not to mention the inconvenience and the complexity of the federal plan. Medicare Part D, for example, allows only 30 pills per pharmacy visit to presumably avoid too many pills being left unused if death claims a patient before their supply is exhausted.

Déjà vu is a common affliction in Maryland’s government. Back in the late 1990s, Gov. Parris Glendening (D) appointed the Thornton Commission, predecessor to the Kirwin Commission. The two carried out essentially the same assignment with basically the same results. Expecting a different outcome would have led to clinical evaluation of insanity, as the saying goes.

And just as the Kirwin expectations have created an economic quandary, so, too, did the Thornton Commission reforms (always be wary of the word) promise generous rewards in a pauper’s will.

Glendening signed Thornton into law but failed to fund it. He bequeathed the tab for Thornton to his successor, Gov. Robert L. Ehrlich Jr. (R). To further crimp the treasury, Glendening, at roughly along the same timeline, unexpectedly cut taxes to ease the way for his reelection in 1998. Ehrlich was forced to raise taxes as well as to boost the annual percentage of budget increases well above their average numbers to cover Glendening’s wishful thinking and personal gratification.

(As the pension system is mentioned above, Glendening, for those who may have forgotten, or never really knew, also tried to raid the Prince George’s County pension system to line his pockets as he left his job as county executive to become governor. His accomplice in the sleight-of-hand was Major Riddick, who followed Glendening to Annapolis as chief of staff and is now back at work in Prince George’s as the chief administrator to County Executive Angela D. Alsobrooks (D). They did it by triggering an “early separation” clause that would have entitled them to overly generous pension benefits before reaching the minimum retirement age. A public outcry when the story broke changed their minds and forced them to forgo the easy money, but not until just after Glendening’s squeaker 1994 election.)

Education is a tough business. Few of the best and brightest choose teaching as a career, and often results do not measure up to the investment, as Hogan gleefully notes at every turn. Buildings are aged, ramshackle and run down and dangerous places to be for both students and teachers. And no matter how much is spent, it’s never enough. People of the pickleball generation can’t understand why air conditioning is an issue.

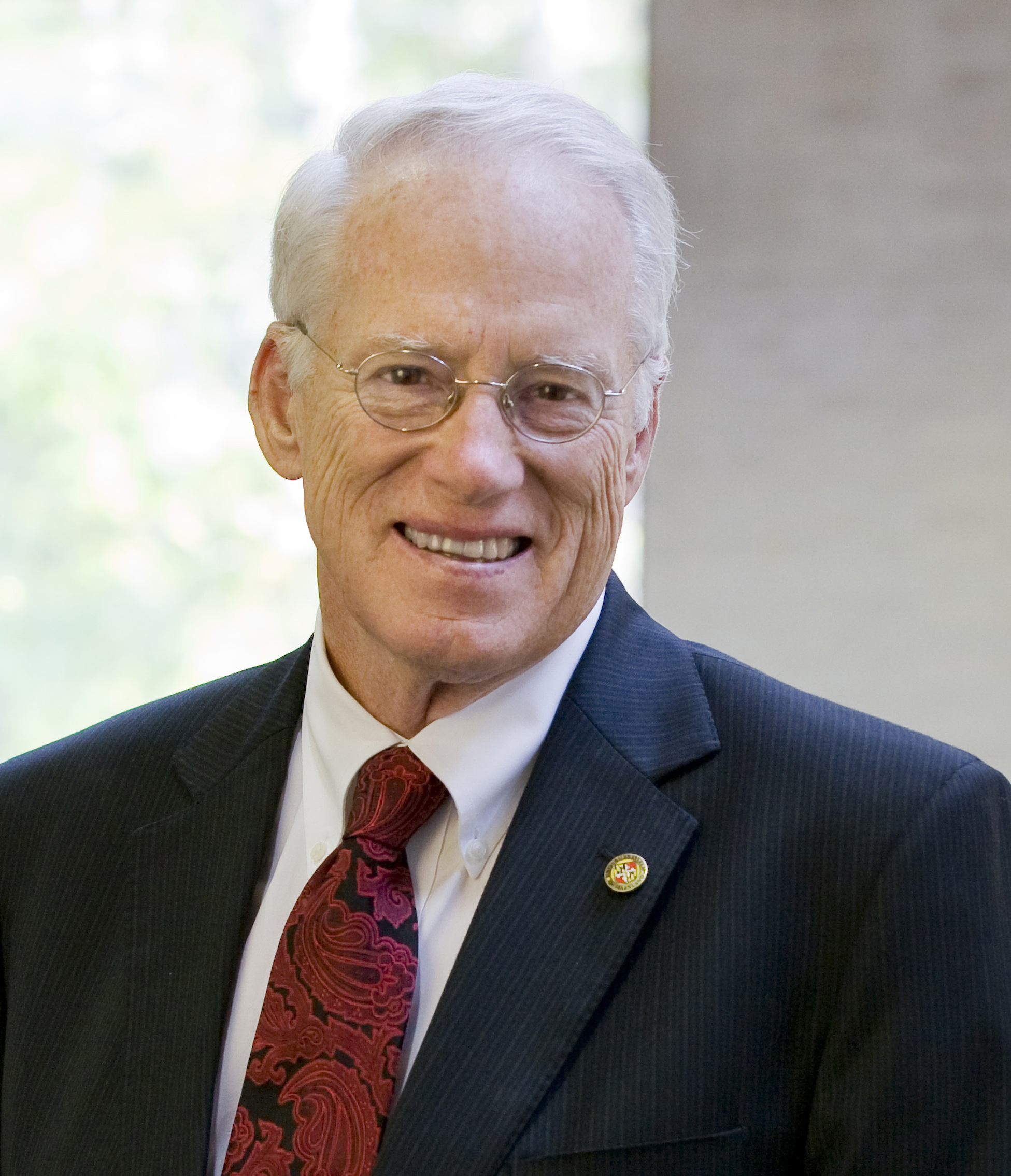

Frank A. DeFilippo

The state school construction program is a case in point. It was originally conceived in the early 1970s as a way to ease pressure on local property taxes. Today, the program has become a mainstay of financing local governments, proving once again that government can never do enough in an area where it previously did nothing.

Teachers in Maryland are middle-income folks. They’ll never get rich, but they’ll never be forced onto welfare, either. Nor do they receive hazardous duty pay as perhaps they should. At certain grade levels, they risk their lives every time they enter a classroom or monitor a hallway. But it is a job which inherently packs its own incentives – the more learning they achieve, the more money they make, and, theoretically, the greater the benefits to students.

Test scores are supposed to be a measure of achievement. But as they appear periodically over the school year, scores roller-coaster from good to bad to neutral, often showing no movement at all in any direction. The efficacy of the testing is often in question, always in doubt, as they are tied not only to student learning but also to teacher ability. There have also been questions about cheating and grade inflation, notably in Prince George’s County, one of the most troubled school systems in the state, along with Baltimore City.

And in Baltimore County, former School Superintendent Dallas Dance was jailed for perjury for failing to disclose that he owned a consulting company that received thousands of dollars from companies that did business with county schools.

Purists will argue that prescription drug coverage has no relationship to schools. It’s true. But both have common cause with taxpayer money. And taking away one had nothing to do with propping up the other. They just happened to coincide. And it’s not as if one class of people is being deprived to support another.

The irritant about ripping 48,000 retirees out of the prescription drug program is the shabby way in which it was done – a deal accomplished furtively in a back room in 2011 with no notice of its finality until doomsday arrived eight years later.

And in the catchpenny world of budgeting, the foolhardiness of advancing $2 billion without having it in the bank violates the legislature’s own prescription that every money bill must identify a revenue source with an accompanying fiscal note.

There are currently 896,845 students enrolled in Maryland’s 1,428 public schools. The state’s constitution says that Maryland must provide an adequate public education for all of its children. There have been many disagreements over what the word “adequate” means as it applies to education.

The per pupil spending in several Maryland school districts is among the highest in the nation, with the most generous being in Montgomery County and Baltimore City, including formulaic compensation for poverty and other local considerations. And there’s the frustration: With roughly the same dollars – close to $20,000 per pupil – one system is turning out scholars and the other is producing squeegee kids.

It’s more cost effective to support pill-popping retirees.

Creative Commons Attribution

Creative Commons Attribution